Our Strategy

Colt prides itself on identifying high-conviction investments at an early stage.

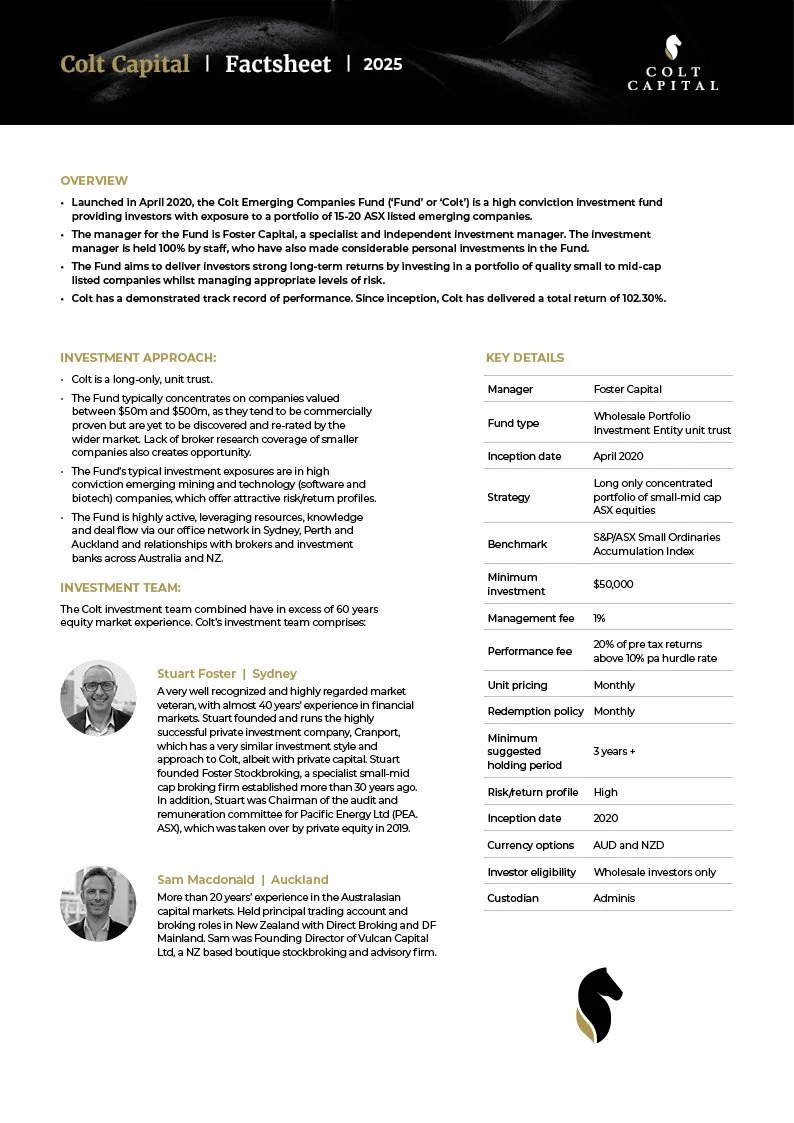

The Fund typically concentrates on companies valued between $50m and $500m market capitalisation, as they tend to be commercially proven but are yet to be discovered and re-rated by the wider market. Lack of broker research coverage of smaller companies also creates opportunity. The Fund’s typical investment exposures are in high-conviction emerging mining and technology (software and biotech) companies, which offer attractive risk/return profiles.

Concentrated portfolio, typically with 15-20 positions. The Fund is highly active, leveraging resources, knowledge and deal flow via our office networks in Sydney, Perth and Auckland and relationships with brokers and investment banks across Australia and NZ.

Whilst we strive for double-digit performance, we never lose sight of the requirement to preserve capital such that we can be opportunistic in increasingly volatile market conditions.

Our Process

-

01

Multiple and regular update meetings with company management and Board personnel in an effort to assess competency, leadership and vision.

-

02

A sound qualitative understanding and assessment of how the business actually makes money and what the key drivers are for the businesses’ profitability.

-

03

Assessment of a company’s balance sheet to ensure that a company is not excessively geared with debt.

-

04

Ultimately assessment of valuation, to ensure we are paying a price which we believe represents good value. The valuation methods deployed by Colt depend upon the type of company and the sector in which they operate but will typically include either a multiplebased approach (i.e. EV/revenue, EV/EBITDA) or DCF analysis.